If you’re covered in student loan debt, then you know how hard it is. It’s like a dark rain cloud following you around, casting a shadow on all the good things in your life. When that rain cloud sticks around long enough, it’s easy to feel hopeless, even desperate. And that can lead to making some pretty poor decisions about your money.

You might even start looking for a quick “get out of jail free” card—like student loan forbearance.

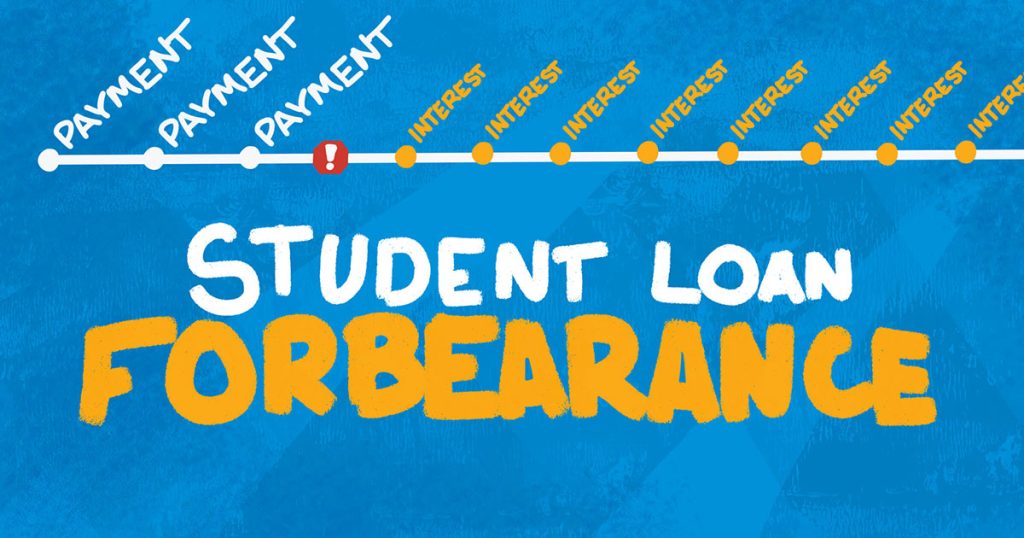

When you choose student loan forbearance, you’re agreeing to postpone or reduce your student loans temporarily. But—and this is a big but—the interest on your loans continues to accrue, aka build up. That accrued interest gets added to your balance. (This type of interest is called capitalized interest.) So, when you “unpause” your loans and start paying on them again, your balance is even larger than when you left it. Yikes.

Look, it can feel like desperate times call for desperate measures. But student loan forbearance is something you want to avoid if you can. It isn’t the magic wand it might appear to be, so let’s take a closer look at what it actually is.

COVID-19 and Student Loans

The pandemic definitely threw some serious wrenches in just about everyone’s financial plans. And since people were too busy trying to cover the necessities to worry about their student loans, the federal government passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act to offer some relief. Here’s what the CARES Act did for student loan borrowers:

1. Federal student loans are on pause until January 1, 2023.

As part of the CARES Act, the federal government issued an “administrative forbearance” on federal student loans, which is just a fancy way of saying your federal student loan payments have been on hold since March 2020. Student loan relief has been extended several times, but it’s finally going to end on December 31, 2022—which means you need to be ready to start making payments again in the new year. Or better yet, if you’re in a position to start making payments now, do it! The sooner you get on top of your loans, the sooner you can get them out of your life.

2. The interest rate is set at 0%.

Also through December 31, 2022, the federal government has set the federal student loan interest rate at 0%. This applies to defaulted and non-defaulted Direct Loans, Federal Family Education Loans and Federal Perkins Loans. If you’re not sure what type of loan you have or if your loan is covered, call your loan servicer and ask. But the best part is that any payments you make during the pause will go directly toward your principal. That means this is a great time to save yourself the interest and make progress paying off your student loans!

3. No interest will accrue during the administrative forbearance.

Since the interest rate for student loans is currently at 0%, your loans aren’t accruing any interest during the pause. So, come January 1, if you haven’t paid on your student loans, they won’t be any larger than when you left them. (But wouldn’t it be nice if they were smaller because you’ve been chipping away at them during the pause?)

How Student Loan Forbearance Works

Under normal circumstances (aka when there’s not a global pandemic), student loan forbearance works very differently.

Ready to get rid of your student loans once and for all? Get our guide.

First off, if you’re in default on your loans, then student loan forbearance isn’t an option. The type of loan you have determines at what point your loan is considered “in default.” For some lenders, that might mean missing even one payment. For others, it could mean missing payments for 270 days or more. The point is, once you’re in default, the forbearance ship has sailed.

(Now, President Biden did introduce a “Fresh Start” initiative to help borrowers in default return to good standing once payments kick back in. This would also allow those borrowers to forbear their loans because they’d no longer be in default. But we don’t have all the details yet about how to take advantage of this fresh start, so you should still prepare to start paying on your student loans in the new year just in case. And keep in mind this is a one-time chance to get caught up—not something you can do over and over again if you fall behind on your payments.)

Also, student loan forbearance should never be your go-to relief strategy (you’ll see why in just a minute). Forbearance is a short-term Hail Mary after all your other options have run dry.

When you forbear on a loan, you’re basically hitting the pause button on making payments for up to 12 months. But guess what’s not paused? Yup, interest. That’s right, that puppy keeps on growing even if you’re not making payments.

And the interest is capitalized, which means if you’re not making interest payments during your forbearance, it builds up each month and gets tacked onto your loan’s balance. Uh, this isn’t good. (The only exception to that rule is with Perkins Loans. While interest still accrues on a Perkin’s Loan, your school may not add the unpaid interest to your principal balance.) So, you could easily end up owing more at the end of your forbearance than when you started. Where’s the relief in that?

Let’s look at an example. Nick has a $10,000 federal student loan with a 5% interest rate. He’s granted a forbearance of 12 months. During that time, he doesn’t pay toward the principal or any interest. At the end of the 12 months, he now owes $10,500. And to add insult to injury, he’ll be paying even more in interest and less toward his principal each month when he restarts his payments because his balance is now bigger.

See how this turns into a rotten deal pretty quickly?

Federal vs. Private Student Loan Forbearance

Generally speaking, student loan forbearance is available for federal student loans. It’s possible to secure a forbearance for private student loans, but don’t count on it.

Federal student loan forbearance pauses or reduces your payments for a period of up to 12 months. At the end of that time period, if you’re still in a financial hardship, you can reapply for an additional 12 months. You can only do this for a total of three years with general forbearances. Mandatory forbearances can continue indefinitely so long as you continue to meet the eligibility requirements (we’ll talk about this more below).

It probably won’t come as any surprise that private student loan lenders aren’t so flexible. If you’re exploring forbearance, first you’ll need to call your lender and see if it’s even a possibility. In a lot of cases, it won’t be.

Some private lenders may offer forbearance, but it’s usually for only a handful of months at a time. You’re not likely to secure a renewal either. Expect your interest to accrue and to be capitalized.

If you end up applying for federal or private student loan forbearance, you must—we repeat, you must—continue paying on your loan until you’re approved for forbearance. Applying isn’t a guarantee that it will happen. What is a guarantee is that if you stop paying on your loan, you’ll become delinquent and eventually default. And you know what you can’t do if you default on a student loan? Ding, ding, ding, you guessed it! Forbear.

Types of Student Loan Forbearance

There are two types of federal student loan forbearance. They operate a little differently, but the goal is the same for both—to hit pause on your student loans for up to 12 months at a time.

General Forbearance

Sometimes called discretionary forbearance, general forbearance can be granted or denied. The owner of your loan makes that call. If it’s granted, you can forbear for up to 12 months. After that time, you’ll have to apply again. But keep in mind that you can only do a general forbearance for a total of three years.

If any of the following circumstances are making it difficult for you to make your monthly student loan payments, then you might be eligible for general forbearance:

- Financial trouble

- Medical expenses

- Changes in employment

- Other situations which your loan owner will assess

Direct Loans, Federal Family Education Loans and Perkins Loans are the only types of loans eligible for general forbearance.

Mandatory Forbearance

Mandatory forbearance is a little more straightforward. If you meet any of the eligibility requirements, the federal government has to grant you forbearance.

You might be eligible for mandatory forbearance if:

- Your monthly student loan payment is 20% or more of your monthly gross income.

- You’re serving in AmeriCorps.

- You’re enrolled in a medical or dental internship or residency.

- You qualify for partial repayment of your loans as part of the U.S. Department of Defense Student Loan Repayment Program.

- You’re a member of the National Guard and have been called up by a governor, and you’re not eligible for a military deferment.

- You’re a teacher providing a teaching service that would qualify you for teacher loan forgiveness.

Direct Loans and Federal Family Education Loans are eligible for mandatory forbearance. Perkins Loans are also eligible for mandatory forbearance if your monthly student loan payment is 20% or more of your monthly gross income.

Deferment vs. Forbearance

There’s another term that gets thrown around a lot as some kind of wonderful, turbocharged solution to student loan debt, and that’s deferment. Student loan deferment is not the same thing as student loan forbearance. Let’s check out some of the main differences between them.

1. You can defer longer than you can forbear.

You can only forbear on federal student loans for up to 12 months at a time. While you can apply for renewal, you can only do that for a total of three years for general forbearance. But with deferment, there’s a wider range of time. Some loans can be deferred for up to three years at a time. Others could go even longer if you continue to meet the eligibility requirements.

2. Deferment is usually tied to a specific life event.

Eligibility for forbearance tends to be more generalized, like financial trouble or medical expenses. Deferment, on the other hand, is usually tied to something specific, like unemployment or undergoing treatment for cancer.

3. Interest does not accrue in deferment.

One of the major drawbacks of forbearance is that you’re still accruing interest on your student loans even when you’re not paying on them. With deferment though, interest doesn’t accrue on subsidized federal student loans or Perkins Loans.

4. If you meet the eligibility requirements for deferment, your loan servicer must allow it.

Unless you’re applying for mandatory forbearance, your loan servicer can decide whether or not to grant you a general forbearance. When you’re seeking deferment though, your servicer has to let you defer if you meet the eligibility requirements.

Deferment and forbearance are both short-term “fixes.” The debt isn’t going away, and in the case of forbearance, it might even be growing. Deferment and forbearance aren’t helping you change your money habits, and they definitely aren’t getting you out of debt faster. While deferment is a better option than forbearance (because at least your loan doesn’t get bigger in deferment), they both keep you stuck. And you want to be moving forward, crushing your money goals!

Other Student Loan Repayment Options

Forbearance is a last-ditch effort—one we would almost never recommend. But there are other options for paying off your student loan debt. Here are just a few.

Income-Driven Repayment Plan

Rather than pausing your loan payments, an income-driven repayment plan adjusts your monthly payment based on your income and family size. Depending on your current financial situation, your payment could go down to zero dollars per month. But before you see that number and get too excited, remember, the debt didn’t vanish just because you’re not paying on it. You still owe that money. There are several types of income-driven repayment plans available, so you’ll want to contact your loan servicer to see if you qualify for one.

Public Service Loan Forgiveness (PSLF) Program

Okay, be really careful here. It sounds dreamy until you realize there’s fine print on top of fine print on top of fine print. Here’s the basics: Public Service Loan Forgiveness is supposed to forgive your remaining student loan balance after you’ve made 120 qualifying monthly payments as part of a qualifying repayment plan while employed full-time for a qualifying employer. Come again? We were ready to jump ship at 120 monthly payments. That’s 10 years before you can apply for PSLF. And even then, you’re not guaranteed to actually have your loans forgiven. Unless it’s your mortgage, we don’t want you in debt to anyone for a decade!

Student Loan Refinancing or Consolidation

Student loan refinancing or consolidation is the only type of debt consolidation Dave recommends.

When you consolidate your federal student loans, you combine them all into one new loan. So now you have just one payment each month instead of a bunch. You’ll also have a chance to turn any of your variable interest rates into fixed rates. (Hello, easier budgeting!)

It’s possible to get a lower monthly payment after you consolidate your loans, but it usually means you’ll have to extend the life of your loan. If you aren’t fired up and ready to pulverize your student loans, that “lower” monthly payment will cost you more in interest in the long run. Nope, no thanks.

With refinancing, you can take your mix of loans (private and federal) to a private lender or bank who will then pay them all off for you. Now, instead of owing on lots of different loans, you just owe one lender. And like with consolidation, you can also use refinancing to kick your variable interest rate to the curb in favor of a predictable, fixed rate. But you should only refinance if it means getting a lower interest rate and a shorter repayment term.

The Best Option for Paying Off Student Loan Debt

We know no one wants to have student loans weighing them down. But we also know that life can throw some nasty curve balls that keep you from making the progress you want. So, if you’re going through a personal or financial crisis (like a job loss or a medical emergency), forbearance might be your only option.

It also helps to have someone in your corner—someone who can answer your questions, give you a plan, and help get you back on your feet (without any judgment). And that’s exactly what our Ramsey financial coaches do. Don’t be afraid to connect with a coach so you can move forward with your money and toward your goals.

But if your finances are stable for the most part, you need to get next-level mad at your student loan debt. Just think what your life could be like without that terrible baggage. And if you’re already all kinds of fed up at your debt, good! That’s the only way you’ll be able to attack your student loans until they’re gone.

Ready to dump your student loan debt forever? Then go ahead and check out The Ultimate Guide to Getting Rid of Student Loan Debt. This course will give you a step-by-step plan for paying off your student loans faster so you can start living the life you’ve been dreaming of. (And spoiler alert: It doesn’t include a plan for spending a decade working for the possibility of having a debt forgiven.)

Read the full article here