Key takeaways

- The Chase Freedom Flex® is a unique cash back credit card that doubles as a great travel rewards card for those who know how to best take advantage of it.

- With no annual fee and the ability to redeem Chase Ultimate Rewards points for travel purchases, the Chase Freedom Flex can save you money without the added cost of carrying the card.

- Pairing the Chase Freedom Flex with other Chase credit cards can help you maximize your rewards and save even more.

While the Chase Freedom Flex®* is marketed as a cash back credit card, there are several reasons why it’s a great card for travel lovers. Not only does it offer a generous selection of travel insurance protections, but its rewards can be redeemed directly for travel, whether you have this card alone or you pair it with a premium travel credit card from Chase.

With its rotating bonus categories and generous rewards on everyday spending, the Freedom Flex can help anyone boost their rewards haul. If you want to earn travel rewards and don’t want to pay another annual fee for a credit card, read on to learn why this card may be exactly what you need.

Why the Chase Freedom Flex is a good card for travelers

Picking up a cash back card for travel may seem strange, but the Freedom Flex works well in different scenarios. Consider the following perks and benefits before you make it part of your travel rewards plan:

Travel rewards redemption

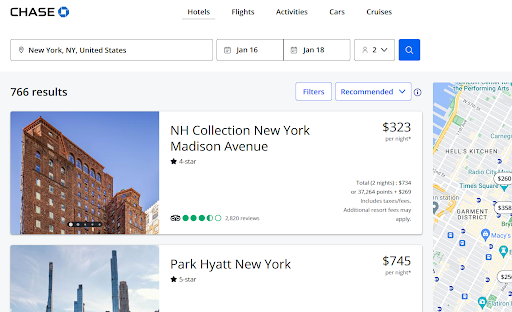

If you feel intimidated by the idea of redeeming your Chase points for travel, know that it’s quite simple. You can redeem points directly through the Chase TravelSM portal, which features choices that take you directly to the booking pages for such travel categories as hotels, flights, travel activities, rental cars and cruises.

EXPAND

From there, Chase will show you how much your travel would cost in points. Here’s an example of how the portal displays your options if you search for a hotel in New York City.

EXPAND

You have the option to pay for your travel plans entirely with points, with a combination of points and credit card charges or entirely with your credit card. If you pay for all or part of your travel through Chase with your Freedom Flex card, you will earn 5 percent back on that spending.

More Freedom Flex travel perks

The Chase Freedom Flex comes with solid travel perks for a no-annual-fee card, but its greatest value comes in working in tandem with premium Chase cards to unlock substantial value.

Pairing with other Chase Ultimate Rewards cards

With the Freedom Flex, you can transfer rewards to a premium Chase travel credit card account for better travel redemptions. If you also have the Chase Sapphire Preferred® Card, for example, you could use each card for purchases in their respective bonus categories, then move all your points to your Preferred account before you redeem. This strategy could help you earn 25 percent more value for your points if you redeem through Chase Travel.

Separately, moving points to your Preferred card or the Ink Business Preferred® Credit Card unlocks the option to transfer rewards to any of Chase’s 14 airline and hotel partners, so you can take advantage of their rewards points or miles instead.

If you have the Chase Sapphire Reserve®, any points you transfer there will now be worth 50 percent more, although that card has the highest annual fee at $550.

While Bankrate values Chase Ultimate Rewards points at around 2.0 cents each, the right travel redemption can provide even greater value, making this the ideal way to get the maximum value from your Freedom Flex.

Pairing the Freedom Flex with a premium card should also help you avoid foreign transaction fees. Since the Freedom Flex comes with a 3 percent foreign transaction fee, you can use it to earn rewards points and use another travel card to pay for purchases while abroad.

Travel insurance

The Freedom Flex comes with a generous amount of travel insurance for a cash back credit card. Perks you’ll qualify for include trip cancellation and interruption insurance worth up to $1,500 per passenger and $6,000 per trip, secondary auto rental coverage and travel and emergency assistance services.

With that said, you can get even more travel insurance protections with a premium Chase travel card. The Chase Sapphire Reserve gets some of the best protections on any card, offering higher trip cancellation and interruption insurance benefits, primary auto rental coverage, trip delay reimbursement, emergency evacuation and transportation coverage, baggage delay insurance, travel accident insurance, roadside assistance and more.

Keep in mind: These benefits are offered free of charge for cardmembers.

Additional pros of the Chase Freedom Flex

In addition to being a great travel rewards card, the Chase Freedom Flex is still a popular, well-rounded cash back credit card. Not only can you earn a high rate of rewards for each dollar you spend, but you can redeem your rewards in several different ways aside from just travel.

-

- Welcome bonus: $200 cash bonus when you spend $500 within three months of account opening

- Intro APR: 0 percent intro APR on purchases and balance transfers for 15 months, followed by a variable APR of 19.74 percent to 28.49 percent

- Intro balance transfer fee: 3 percent of the amount of each transfer with a $5 minimum, followed by 5 percent of the amount of each transfer with a $5 minimum after the 60-day intro period

- Annual fee: $0

More ways to earn bonus rewards

The Chase Freedom Flex is one of the top no-annual-fee cards on the market. What makes it unique is that it offers rotating bonus categories and bonus rewards in several everyday spending categories. Here’s the card’s current rewards structure:

- 5 percent cash back on activated bonus category purchases each quarter (up to $1,500 in purchases, then 1 percent)

- 5 percent back on travel purchases through Chase Travel℠

- 5 percent back on Lyft rides (through March 2025)

- 3 percent back on dining and drugstore purchases

- 1 percent back on everything else

While Chase Freedom Flex categories can change over time, they frequently include options like gas stations, home improvement stores, Walmart and PayPal purchases and more.

Just make sure to remember to activate the bonus categories each quarter. If you don’t remember, you have until the 15th of the last month of the quarter to activate. The 5 percent category for travel purchases through Chase Travel℠ is also pretty broad and can include airfare, hotels, rental cars and day trip activities.

More ways to redeem rewards

While the Freedom Flex is a cash back credit card by name, the rewards you earn are actually Chase Ultimate Rewards points. This distinction is part of what makes the Freedom Flex such a great travel rewards card. The points you earn have a cash value of 1 cent each, so the $200 welcome bonus, for example, would be worth 20,000 points.

In addition to redeeming your rewards for travel through the Chase Travel portal, the program lets you redeem your rewards for cash back or statement credits. You can also redeem your points for things like gift cards and merchandise. However, you’ll get far better value if you have a premium card to transfer points to use for travel redemptions.

Should you get the Chase Freedom Flex for travel purchases?

Considering the Freedom Flex offers generous rewards in multiple everyday categories, you can’t really go wrong. If your spending lines up with the card’s highlighted categories, then you’ll be able to rack up the rewards points pretty easily.

The Freedom Flex is an even better choice for current Chase customers who have a premium travel credit card they can pair it with. When you have a few different Chase credit cards, or even better, the Chase trifecta, you get bonus rewards in more categories, all the best redemption options and the best selection of travel protections all at once. Just make sure you transfer your points from your Freedom Flex to your premium Chase card before booking travel so that you get the most out of your points.

The bottom line

The Chase Freedom Flex is an excellent credit card for people who travel occasionally and want some basic travel protections, as well as for those who travel all the time and want a way to boost their travel rewards haul as part of a larger family of Chase cards. Plus, with no annual fee, it costs nothing to add to your wallet and take advantage of its high rewards rates.

*Information about the Chase Freedom Flex® has been collected independently by Bankrate. Card details have not been reviewed or approved by the issuer.

Read the full article here