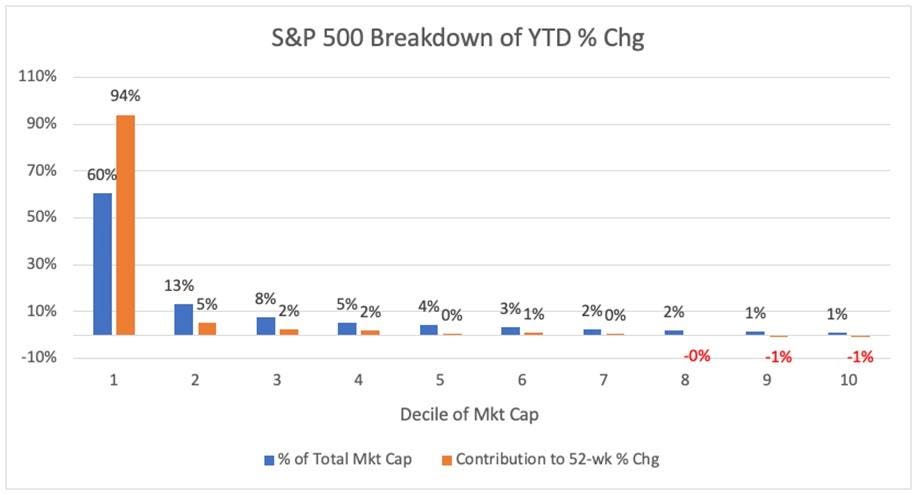

It has been a good year for the large capitalization market averages. The S&P 500 is up about 14% so far this year. However, the gains continue to be extremely lopsided. The top-50 stocks by market capitalization in the S&P 500 make up nearly all of the gains, far outpacing their market cap contribution. This is shown clearly below in Figure 1.

Figure 1: Contribution to S&P 500 YTD Gain

Even further, one stock, Nvidia (NVDA), makes up around 35% of the overall gains and the top-10 stocks (MSFT, AAPL, NVDA, GOOGL, AMZN, META, LLY, AVGO, TSLA, JPM) make up nearly 80% of the S&P 500 gains. Furthermore, the top-10 stocks have increased their share of the total market cap from 32% to nearly 38%.

There are two additional ways to check the concentration and/or lack of breadth in the overall market:

1) Relative Strength (RS) lines of cap-weighted versus equal-weighted indices. The annotated Datagraphs® below demonstrate in both the S&P 500 and the Nasdaq 100 how much the top stocks have dominated performance.

Figure 2 and 3: Monthly Charts of Cap-Weighted versus Equal-Weighted S&P 500 and Nasdaq 100

2) Oscillators of equal-weighted indices versus cap-weighted: These oscillators show how far above the norm the outperformance of these select mega-cap stocks have been relative to history.

While it was slightly more extreme back in March and April of this year, the level is high. It is near a historical extreme level though it is still slightly below the bottom level.

Figures 4 and 5: Trailing 12-Month Relative Graphs of Equal-Weighted versus Cap-Weighted S&P 500 and Nasdaq 100

The concentration of the major Indexes has come at the expense of small capitalization stocks more than anything else. Smaller stocks are going on three years of downside performance with only a very minor 2–3 month periods of reversion. 1994–1999 lasted longer however, before an eventual shift in favor of small capitalization stocks occurred.

Figures 6: Relative Long-Term Graph of S&P 500 vs. Nasdaq 100 and S&P 500 vs. Russell 2000

The two well-documented periods where concentration eventually led to the end of a bull market were in 2000 and in 1973. Figure 7 below is the S&P 500 chart from the 1970’s, which, despite a lack of a small-capitalization or an equal-weighted index to compare to, shows the sharp relative strength line below versus the DJIA. It had been building for several years and flatlined near the market highs in 1973, before leading to a significant bear market.

Figure 7: S&P 500 Monthly Chart – Relative Strength Line vs. Dow Industrials

However, the other option is the rest of the market could catch up in terms of performance. We saw this most recently in late-2020. After the S&P 500 led the Russell 2000 dramatically for roughly two years, which included the post-COVID lows, the Russell 2000 put on a historic period of outperformance from mid-2020 through early-2021, catapulting the overall market much higher.

While the market’s concentration does not have to ease immediately, we will be looking for signs of a change. These would include a resurgence in the number of breakouts (Figure 8) across the market. A dramatic spike in breakouts to the +120 (ex-Financials and Technology) or higher consistent level usually heralds a major move up in the market and, sometimes, a new bull market. Also, we would like to see a pickup in other groups or themes outside of mega-cap Technology. Currently, there is a lack of thematic leadership outside of artificial intelligence and the GLP-1 weight loss drugs areas represented by Eli Lilly (LLY) and Novo Nordisk (NVO). Formerly leading groups like housing, infrastructure, apparel, and others, have suffered more recently at the hand of the increased concentration.

Figures 8: Weekly Breakouts Graph

We conclude with two points. First, it is unlikely that the current condition of a small number of stocks driving the market higher will continue for much longer. While there have been periods with slightly more extreme levels, given the length of time this current condition has lasted, we think a change will occur soon. Second, we are unwilling to forecast which form this change will take; a decline in the leaders or an increase in performance of the numerous segments that have lagged. However, we are alertly monitoring for any signal that such a change has started. We would advise investors to do the same.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Co., an affiliate of O’Neil Global Advisors, made significant contributions to the data compilation, analysis, and writing for this article.

Disclosures

No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed herein. O’Neil Global Advisors, its affiliates, and/or their respective officers, directors, or employees may have interests, or long or short positions, and may at any time make purchases or sales as a principal or agent of the securities referred to herein.

O’Neil Global Advisors, Inc. (OGA) is an SEC Registered Investment Adviser. Information relating to investments in entities managed by OGA is not available to the general public. Under no circumstances should any information presented in this report be construed as an offer to sell, or solicitation of any offer to purchase, any securities or other investments. No information contained herein constitutes a recommendation to buy or sell investment instruments or other assets, nor to effect any transaction, or to conclude any legal act of any kind whatsoever in any jurisdiction in which such offer or recommendation would be unlawful. The past performance of any investment strategy discussed in this report should not be viewed as an indication or guarantee of future performance. Nothing contained herein constitutes financial, legal, tax or other advice, nor should any investment or any other decision(s) be made solely on the information set out herein.

© 2024, O’Neil Global Advisors Inc. All Rights Reserved. No part of this material may be copied or duplicated in any form by any means or redistributed without the prior written consent of OGA.

Read the full article here