Technology has changed how listeners consume music. Music lovers once accessed their favorite tunes on physical media like cassettes and compact discs, but today, brands such as Apple, Spotify and YouTube have redefined the experience.

Analysts predict that, as a result, the value of royalties, licenses and other related assets will rise with increased competition, presenting opportunities for artists, labels and investors alike.

This beginner’s guide explores the investment potential, some popular trends in this fast-evolving industry and how you can start investing.

Key takeaways

- The music industry is booming and continues to present significant opportunities to potential investors.

- Those looking to invest in the music industry may want to consider categories like music streaming, royalties and live music and concerts.

- There are multiple ways to invest in the music industry, from stocks and exchange-traded funds (ETFs) to crowdfunding platforms.

How to invest in music streaming

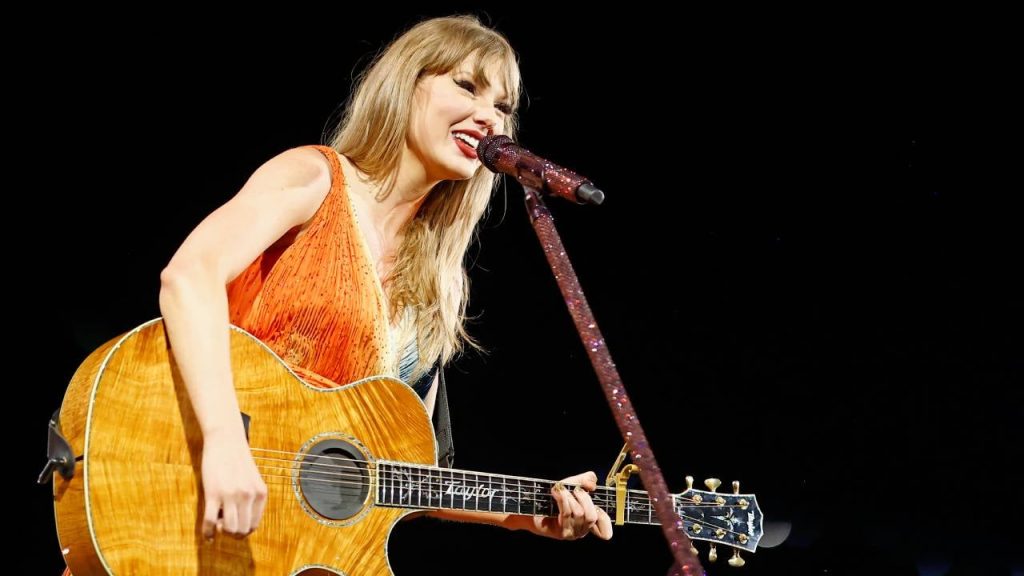

Popular artists such as Taylor Swift, Beyoncé and Ed Sheeran have generated billions of views on YouTube, revealing the power of technology and mass distribution in the music industry. And it doesn’t stop there — from streaming companies like Spotify to device makers like Apple and even social media companies that use big data and analytics to determine people’s interests and tastes — tech companies have impacted the music industry in a number of ways.

Of course, streamers have been among the biggest beneficiaries. According to the Recording Industry Association of America (RIAA), revenue for streaming services in the U.S. stood at a record high of $17.1 billion in 2023, the most recent year for which annual figures have been released. That figure accounts for 84 percent of total music industry revenue. Moreover, paid subscriptions to streaming companies increased by 9 percent to $11.2 billion in 2023.

Those interested in investing in streaming services have several public companies to choose from. These include Spotify (SPOT), Apple (AAPL), Alphabet’s (GOOG) YouTube, Amazon (AMZN), Sirius XM (SIRI) and iHeartMedia (IHRT).

How to invest in music royalties

Another way to invest in the music industry is by tapping into music royalties. One of the benefits of investing in royalties is diversification. Investors aim to diversify their portfolios through various asset classes such as stocks, real estate, art and perhaps royalties. Different asset classes carry varying levels of risk, so it’s prudent to consider each option carefully and discuss them with a qualified financial advisor.

In an attempt to profit from royalties, some investors have turned to crowdfunding companies like SongVest. Founded in 2007, this fintech company acts as an online marketplace to buy and sell music royalties at auction.

Other platforms, such as Royalty Exchange, match investors with artists seeking funding in exchange for royalties. The company claims to have raised more than $190 million for content creators through more than 2,300 deals.

Crowdfunding platforms offer many types of royalties, investment durations and licensing agreements, so investors must exercise due diligence before committing any capital. You may also find it useful to read this guide comparing the differences between investing and trading.

How to invest in live music and concerts

In 2020, the global pandemic dealt a significant blow to the live music industry, with many public companies losing more than half their market value. However, venues have since reopened, and live events have made a full comeback as an investment opportunity.

In November 2024, Live Nation Entertainment (LYV), which owns Ticketmaster, announced that profitability had increased by 39 percent to $474 million in the third quarter compared to the previous year. While there’s still plenty of room for growth, pent-up demand for in-person events has led to a big comeback for live concerts, which in turn creates an opportunity for investment.

With new signs of life in the space, investors may want to consider stocks like Madison Square Garden Sports (MSGS) and Eventbrite (EB), which could also benefit from the uptick in attendance.

Frequently asked questions

Bottom line

Investing in the music industry provides long-term opportunities. As the industry evolves, retail investors have access to public stocks, exchange-traded funds and crowdfunding platforms. For those more in tune with the industry, there’s memorabilia and even music instruments such as vintage guitars and pianos that become collectors’ items over time and can fetch tens of thousands of dollars.

However, like any other thematic investment, there are also potential risks. So before investing, review all available information — and maybe consult with a financial advisor — to determine whether music sounds like a smash hit (or a miss) for your portfolio.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

— Bankrate contributor Daniel Bukszpan contributed to an update of this article.

Read the full article here