The Capital One Savor Cash Rewards Credit Card is a great rewards card to have in your wallet if you’re all about food, travel and entertainment. But is it the best fit for you overall, or could one of the other top cash back credit cards suit your needs better?…

Key takeaways Online banks usually carry the same FDIC insurance as traditional banks. Because they don’t carry the operating expenses of traditional banks, online banks can offer more competitive APYs and better rewards. Look for online banks with features that protect your data, such as multi-factor authentication, encryption, fraud monitoring…

Key takeaways Construction loans are short-term loans that you can use to build a home. Some construction loans can be converted to mortgages after your home is finished. Construction loans typically have tougher criteria and higher interest rates than conventional mortgages for existing homes. If you can’t find the right…

An annuity can provide you with a steady stream of income, ensuring that you have money when you need it. That’s why many people turn to annuities during retirement, to be sure that they have cash flow when they’re no longer working. If you’re looking to buy an annuity, you’ll…

Personal Finance

Washington is abuzz over whether Congress will address President-elect Donald Trump’s ambitious policy agenda in one bill or two. But…

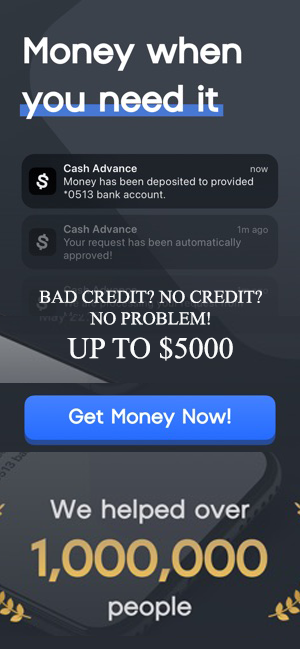

TomoCredit, a five-year-old San Francisco startup that claims it boosts consumers’ credit scores, is facing a growing number of problems,…

Millions of student loan borrowers face an uncertain future as a second Trump administration prepares to return to Washington. But…

The 2024 presidential election has ended, and Donald Trump is poised to retake the White House, with big implications for…

Featured Articles

Wildfires in southern California have burned at least 47,000 acres in the Los Angeles area—the largest blaze, the Palisades Fire, has burned more than 23,000 acres. Thanks to dry and windy conditions, the fires are continuing to spread. At least 25 people are believed to…

Dept Managmnt

Key takeaways Credit repair is a term used to describe the process of restoring your credit rating. You can hire a credit repair…

Banking

Thanks to more than a decade of Dodd-Frank and Basel III regulations, the Trump administration inherits a well-capitalized and liquid banking system. Squandering…

Credit Cards

Key takeaways The Southwest Companion Pass is attainable by using Southwest credit card welcome bonuses to meet the 135,000-point requirement. Applying for a…

All News

Hurricane Helene devastated much of western North Carolina like no other storm in recent history. Rain poured down the mountains, acting like a funnel to the already-swollen streams and creeks feeding into the Broad, Toe and Swannanoa Rivers. The red clay soil, already saturated with water from three days’ rain,…

As the year draws to a close, the anticipation of a New Year’s Eve celebration brings excitement and joy. It’s a time to reflect on the past year and welcome the new one with open arms. Hosting a New Year’s Eve party can be a delightful way to gather with…

Credit Sesame with some tips on how to smash your credit goals in 2025. Setting credit-related goals may not seem like an exciting New Year’s resolution, but it can have a lasting impact on your life. Whether you’re looking to boost your credit score, manage debt more effectively, or simply…

Life insurance has many purposes: It can bring peace of mind, support loved ones financially and play an important role in an estate plan. But it can be confusing to know which type of policy is right for you. For some older individuals, guaranteed life can be a good choice.…

The 2025 tax season is approaching fast: Do you know how to find your tax bracket? In the U.S., your tax rate is tied to which bracket you fall into, based on your taxable income and filing status. Knowing how to calculate your tax rate — both your effective tax…

Richard Drury/ Getty Images; Illustration by Austin Courregé/Bankrate As the New Year looms, there’s a new low in home equity lending. The $30,000 HELOC (home equity line of credit) plunged nine basis points to 8.43 percent—rates we haven’t seen in about a year and a half, according to Bankrate’s national…

Key takeaways Chase and Wells Fargo feature a range of popular rewards credit cards for consumers and small businesses. Options from both banks include cash back credit cards and travel credit cards that offer point transfers to airline and hotel programs. Before you choose between these two issuers, make sure…

Key takeaways Standard FDIC and NCUA insurance covers up to $250,000 of deposits and interest earned on those deposits. Online-only banks also provide FDIC insurance, but fintech companies aren’t part of the FDIC network. Before you open an account at a bank or credit union, it’s wise to verify that…

The holidays are quickly approaching, and your shopping may already be in full swing as you search for the perfect presents and festive decorations to celebrate Christmas, Hanukkah or Kwanzaa. Shoppers expect to spend an average of $902 per person on gifts and other holiday expenses during the 2024 holiday…

The Good Brigade/Getty Images Historic homes often have different coverage needs than newer builds. Homes with older plumbing and electric systems and homes of historical interest, like those on the National Register of Historic Places, are probably insured with an HO-8 policy instead of a more standard HO-3. Older homes…