Key takeaways Cashback Monitor offers a snapshot of earning rates across dozens of shopping portals, so you can easily see which site offers the most cash back, points or miles. You can customize the Cashback Monitor site to show your preferred shopping portals and other features, but you need to…

Key takeaways The Capital One Venture X Rewards Credit Card is a premium travel credit card with a $395 annual fee. However, you can recoup the annual fee if you take advantage of card benefits — like the up to $300 in statement credits for booking travel through Capital One…

Yellow Dog Productions/Getty Images Key takeaways Acceleration clauses, a common feature in mortgage contracts, require that you pay off your entire loan balance immediately in a single lump sum. There are specific conditions that could trigger an acceleration clause, like missing mortgage payments or canceling your homeowners insurance. Contact your…

Underinsured motorist coverage, or UIM, may be one of the least understood types of car insurance, but it’s increasingly important in an era of rising rates and precarious driving. Rising prices can easily leave drivers underinsured — sometimes unknowingly — and this key coverage gives drivers a way to recover…

Personal Finance

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

Lifestyle inflation occurs when your expenses increase as you earn more income. It can start subtly—dining at pricier restaurants, upgrading…

Chime, the largest digital bank in America, grew its revenue to $1.7 billion in 2024, an increase of roughly 30%…

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

Featured Articles

Tariffs could cost the average American household $3,800 in 2025, according to The Budget Lab at Yale University. This estimate comes even as President Trump announced a 90-day pause on tariffs earlier this month, temporarily reducing most tariffs to 10% in the meantime, while maintaining…

Dept Managmnt

Level 2: Discover the Fastest Way to Pay Off Debt With Rules and Challenges When looking for the fastest way to pay off…

Banking

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many banks from making…

Credit Cards

All News

Key takeaways For young people, building a good credit score can open many doors, including renting an apartment and getting your own phone plan. There are multiple ways to start building credit as a student, such as becoming an authorized user, opening a student credit card or getting a cosigner.…

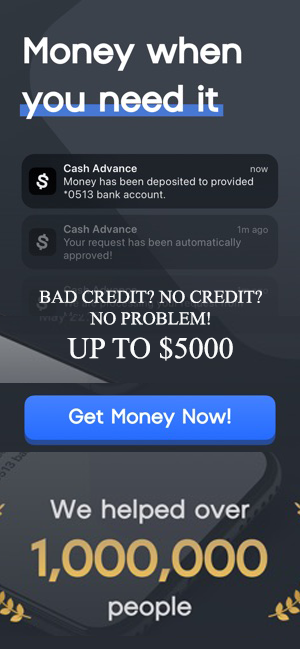

Key takeaways Predatory lending refers to any unfair practice that benefits the lender and makes it difficult for a borrower to repay debt. Signs of a predatory loan include language like “guaranteed” approval, an inflated interest rate, hidden fees and tacked-on financial products you didn’t ask for. Be sure to…

Key takeaways You can earn airline miles by spending on an airline credit card or travel credit card, so you shouldn’t typically need to purchase them. However, you might want to consider buying miles if you get a better deal than paying for a flight in cash, or if you’re…

Key takeaways Bump-up CDs allow you to raise your interest rate at least once during your CD term. Guidelines and restrictions on bump-up CDs vary between financial institutions. Bump-up CDs are generally most beneficial when interest rates are on the rise. When interest rates rise, a bump-up certificate of deposit…

Antonio Guillem/Shutterstock Key takeaways If you have an existing mortgage, and your mortgage company goes bankrupt, your loan will be sold to another company. If your loan has been sold, continue to make your mortgage payments. The terms of your loan will remain the same. If you’re in the midst…

Key takeaways ChexSystems is a consumer reporting agency that banks and credit unions use to screen account applicants. You can dispute errors in your report and settle any outstanding debts to improve your chances of opening a new bank account. If all else fails, you can consider a second-chance checking…

Key takeaways Debt consolidation puts multiple debts into a single account to make your payments easier to manage. Consolidating debts may temporarily reduce your credit score, but your score will improve over time as long as you make payments on schedule. You can minimize the impact on your credit through…

Key takeaways Home equity loans are second mortgages: Borrowers convert all or part of their homeownership stake into ready cash, with the home as collateral for the debt. Home improvement loans are unsecured personal loans geared to be large enough for renovation projects. Home equity loans carry longer terms and…

Exchange-traded funds, or ETFs, are one of the most popular ways to invest. ETFs allow investors to hold a basket of securities in a single fund and trade on an exchange throughout the day like stocks. Many ETFs also come with low expense ratios, which means more of the return…

Key takeaways After the holder of a sole-owned bank account dies, the account may go to a designated beneficiary or be handled by the executor of the estate. Joint accounts often have rights of survivorship, but it’s important to confirm this with your bank to ensure smooth access to funds.…