Images by Getty Images; Illustration by Issiah Davis/Bankrate Key takeaways Semi-truck loan timelines range from 24 hours to up to 90 days, depending on the lender and loan type Banks and credit unions tend to take longer to fund semi-truck loans than online or direct lenders Check eligibility requirements and…

Buying a home is an expensive process, and one of the most significant expenses you’ll pay is often your real estate agent‘s commission. When you consider the fact that each agent involved in a transaction typically earns 2.5 to 3 percent of the home’s sale price, the total cost of…

Key takeaways Applying for preapproval can help you know how much you can afford and negotiate at the dealership. The higher your credit score is, the lower your interest rates may be. Lenders offer competitive terms to borrowers with good to excellent credit. Have a budget in mind and know…

Andrei Medvedev/Shutterstock Key takeaways A pocket listing is a home for sale that isn’t publicly listed on the multiple listing service (MLS). Sellers can work with agents to let them know they prefer to keep their home quiet and only make it available to serious buyers. Some agents love pocket…

Spotlight This Week

More ArticlesPersonal Finance

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

Lifestyle inflation occurs when your expenses increase as you earn more income. It can start subtly—dining at pricier restaurants, upgrading…

Chime, the largest digital bank in America, grew its revenue to $1.7 billion in 2024, an increase of roughly 30%…

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

Featured Articles

Key takeaways Cashback Monitor offers a snapshot of earning rates across dozens of shopping portals, so you can easily see which site offers the most cash back, points or miles. You can customize the Cashback Monitor site to show your preferred shopping portals and other…

Dept Managmnt

Level 2: Discover the Fastest Way to Pay Off Debt With Rules and Challenges When looking for the fastest way to pay off…

Banking

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many banks from making…

Credit Cards

All News

If the March Madness office betting pool doesn’t quite scratch your itch for action, Robinhood’s (HOOD) got you covered. This week, the broker launched a prediction markets trading platform in the Robinhood app, enabling customers to “engage with events that align with their interests” by trading contracts on the outcome of…

Key takeaways The Trump administration’s tariffs against Mexico, Canada and China could soon affect prices on store shelves. Experts estimate that the average household might pay thousands more annually for everyday expenses due to tariffs. You can compensate for higher prices by comparing costs at different stores, shopping sales and…

Klaus Vedfelt/Getty Images Dividend investing is often touted by investors who appreciate the steady and growing income that dividends can provide. But there’s an aspect of dividends that sometimes gets overlooked. “Investing is an activity in which consumption today is foregone in an attempt to allow greater consumption at a…

Nobody likes to get a bill, but when it comes to car insurance, chances are you’ve been extra wary of receiving your renewal letters lately. With average car insurance rates increasing by over 30 percent in the past two years, drivers across the country are wondering when they can expect…

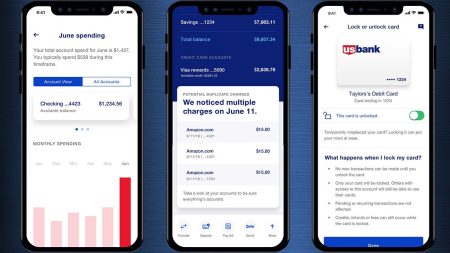

Key takeaways Mobile banking usage continues to surge, with 86 percent of consumers using their banking app weekly in 2025, up from 78 percent in previous years. Advanced mobile banking features now include AI-powered financial insights, enhanced biometric security, real-time fraud detection, integrated investment management and personalized financial wellness tools.…

Courtney Hale/Getty Images Key takeaways Physician mortgage loans are designed to help medical professionals become homeowners. These loans often have looser requirements, such as higher acceptable debt-to-income ratios, and more generous terms, such as no down payments. While most physician loans are geared toward primary residences, some lenders offer loans…

Kelvin Murray/Getty Images Key takeaways Prequalification is a simple, quick process that provides a general indication whether you would qualify for a mortgage. Preapproval requires extensive financial documentation and provides a much firmer maximum loan amount. You can’t use a prequalification as evidence of financing when making an offer on…

Key takeaways A home equity line of credit (HELOC) is a popular and versatile way for homeowners to access cash by borrowing against the home’s value. The six best uses for a HELOC are home improvements or repairs, paying for education or emergencies, consolidating high-interest debt, starting a business and…

Hispanolistic/GettyImages The deadline is fast approaching to get your share of over $1 billion in unclaimed tax refunds. More than 1.1 million people have yet to claim their 2021 tax refunds, the IRS says — and the last day to do so is April 15. Deadline looms to claim tax…

Key takeaways Most car insurance carriers require a “down payment,” or first policy payment, right away to activate your policy. Auto-Owners, Geico and USAA may offer cheap car insurance for drivers on tight budgets. Although paying monthly may be easier on your budget, it can cost more than paying a…

Editor's Pick