PhotoAlto/Frederic Cirou/GettyImages; Illustration by Hunter Newton/Bankrate Key takeaways If you pay off your monthly balance in full by each statement’s due date, you typically avoid paying interest on your purchases — but if you carry a balance, your issuer charges you interest until your statement is paid in full. Cash…

When people clean their homes in the spring, they have to determine what to keep and what to toss. Financial accounts also need their own form of spring cleaning. But how do you know when it’s time to declutter your accounts? I never thought much about how many bank accounts…

Key Takeaways Overdraft fees occur when your account has a negative balance due to a withdrawal, transfer or debit. Overdraft fees can be costly, but some banks have eliminated them or cut them. It’s important to be aware of your account balance to avoid overdrafts. Check your account regularly and…

Money orders allow you to securely send or receive payments, without having to share sensitive bank account information. They are similar to checks but they can’t bounce because they’re prepaid. They can, however, get canceled or refunded if not filled out correctly so it’s important to know what information you’ll…

Personal Finance

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

Lifestyle inflation occurs when your expenses increase as you earn more income. It can start subtly—dining at pricier restaurants, upgrading…

Chime, the largest digital bank in America, grew its revenue to $1.7 billion in 2024, an increase of roughly 30%…

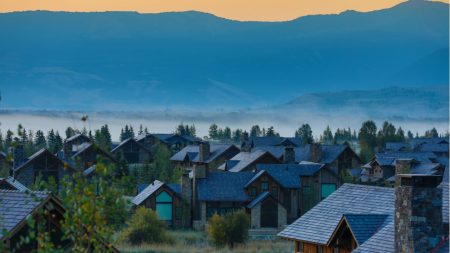

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

Featured Articles

Daniel Zuchnik/Getty Images The stock market has had a bumpy start to 2025, with major indexes such as the S&P 500 and Nasdaq Composite falling into correction territory and several recent market darlings seeing major declines. But legendary investor Warren Buffett and his vast conglomerate…

Dept Managmnt

Budgeting and Building an Emergency Fund for Rising Costs If rising costs are stressing you out, you may require adjustments to your budget…

Banking

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many banks from making…

Credit Cards

All News

Thomas Barwick/Getty Images Key takeaways If you’re seeking more affordable mortgage payments, a loan modification or a refinance could both help. Loan modifications are for homeowners experiencing financial hardship who are unable to make timely mortgage payments but want to stay in their homes. Mortgage refinancing replaces your current…

MoMo Productions/Getty Images Key Takeaways A split direct deposit divides a portion of each of your paychecks between multiple bank accounts – typically a checking account and a savings account. By programming a certain amount to land in a savings account from every paycheck, you can train yourself to live…

The stock market can feel like a roller coaster — thrilling on the way up and terrifying on the way down. If you’re staring at headlines predicting a crash, it’s natural to worry about your portfolio. After all, no one wants to see their hard-earned retirement savings evaporate overnight. You…

Women’s participation in the economy has risen steadily over the decades when it comes to education, workforce experience and increased earnings. However, significant challenges remain that include a wage gap between women and men, as well as other barriers women face in growing their wealth. When it comes to financial…

Photography by Getty Images; Illustration by Bankrate Key takeaways The Free Application for Federal Student Aid (FAFSA) must be submitted for each year of enrollment. One form covers both semesters of the school year with payments issued every quarter or semester. The date of filing depends on where you live,…

Key takeaways College graduates can make about 50% more than high school graduates. The highest upward salary trends are in the agriculture, business, engineering and computer science fields. Disparities still exist based on age, race and gender: women, racial minorities and older workers make less. This year’s college graduates face…

Key takeaways People can find travel credit cards that are co-branded with a specific airline or hotel loyalty program, as well as general travel credit cards that apply to most types of travel. Many frequent travelers sign up for a new travel credit card in order to score a big…

Delmaine Donson/Getty Images Many checking accounts don’t pay any interest, but if they do, it’s typically under 1 percent. However, a temporary promotion currently offered on Bask Bank’s high-interest checking account lets customers earn up to 4 percent annual percentage yield (APY) on their balance. Here’s how the it works: …

Key takeaways For young people, building a good credit score can open many doors, including renting an apartment and getting your own phone plan. There are multiple ways to start building credit as a student, such as becoming an authorized user, opening a student credit card or getting a cosigner.…

Key takeaways Predatory lending refers to any unfair practice that benefits the lender and makes it difficult for a borrower to repay debt. Signs of a predatory loan include language like “guaranteed” approval, an inflated interest rate, hidden fees and tacked-on financial products you didn’t ask for. Be sure to…