Images by Getty Images; Illustration by Issiah Davis/Bankrate Key takeaways Semi-truck loan timelines range from 24 hours to up to 90 days, depending on the lender and loan type Banks and credit unions tend to take longer to fund semi-truck loans than online or direct lenders Check eligibility requirements and…

Buying a home is an expensive process, and one of the most significant expenses you’ll pay is often your real estate agent‘s commission. When you consider the fact that each agent involved in a transaction typically earns 2.5 to 3 percent of the home’s sale price, the total cost of…

Key takeaways Applying for preapproval can help you know how much you can afford and negotiate at the dealership. The higher your credit score is, the lower your interest rates may be. Lenders offer competitive terms to borrowers with good to excellent credit. Have a budget in mind and know…

Andrei Medvedev/Shutterstock Key takeaways A pocket listing is a home for sale that isn’t publicly listed on the multiple listing service (MLS). Sellers can work with agents to let them know they prefer to keep their home quiet and only make it available to serious buyers. Some agents love pocket…

Spotlight This Week

More ArticlesPersonal Finance

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

Lifestyle inflation occurs when your expenses increase as you earn more income. It can start subtly—dining at pricier restaurants, upgrading…

Chime, the largest digital bank in America, grew its revenue to $1.7 billion in 2024, an increase of roughly 30%…

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

Featured Articles

Key takeaways Cashback Monitor offers a snapshot of earning rates across dozens of shopping portals, so you can easily see which site offers the most cash back, points or miles. You can customize the Cashback Monitor site to show your preferred shopping portals and other…

Dept Managmnt

Level 2: Discover the Fastest Way to Pay Off Debt With Rules and Challenges When looking for the fastest way to pay off…

Banking

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many banks from making…

Credit Cards

All News

Key takeaways Filing for bankruptcy can help you discharge debts and regain control of your finances. Bankruptcy clears many kinds of debt but does not necessarily release you of all debt obligations. Owed taxes and court-mandated payments like alimony and child support often must still be paid, even after bankruptcy…

Key takeaways Applying for a business startup loan can help build credit and provide access to funds to cover working capital, inventory, equipment costs and more Startups may face difficulty securing traditional small business loans due to strict eligibility requirements Alternatives to startup business loans include bootstrapping, grants, and crowdfunding…

Many workers look forward to escaping the demands of the working world as soon as they’re able to. But whether you’re a Financial Independence, Retire Early (FIRE) proponent or someone just looking to retire a bit early at age 62, you’ll need to prepare for your years in retirement. And…

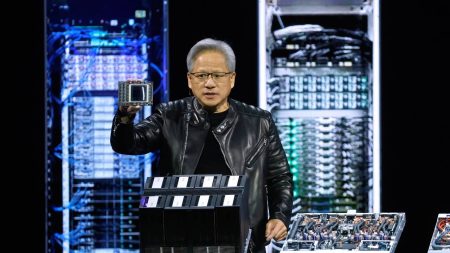

Justin Sullivan/Getty Images Nvidia is hosting its annual GPU Technology Conference, and kicked off the week with news of its next-generation chips, amping up analysts’ expectations of the company’s growth path. The event occurs amid a market environment that seems ready to question the sustainability of the chipmaker’s growth, as…

MoMo Productions/Getty Images Key takeaways Per diem interest is the interest a mortgage lender charges for the days between your closing date and the first day of the billing cycle. Lenders may ask you to pay per diem interest as a lump sum payment or roll the amount into your…

Key takeaways Setting up automatic payments allows bills to be paid without manual intervention on the date specified. Autopay can save you time and ensure your bills are paid on time, which can potentially improve your credit score. Even with autopay enabled, you should regularly monitor your charges and ensure…

Key takeaways Unsecured business loans are types of business loans that do not require collateral Lenders are more selective with which businesses they offer unsecured loans to and may require a personal guarantee or UCC lien Unsecured business loans can come in the form of term loans, business lines of…

Key takeaways Leasing a used car can be a more affordable option compared to leasing a new car. Researching lease options and negotiating with the dealer are important steps in leasing a used car. The drawbacks of leasing a used car include limited inventory and mileage restrictions. Used cars depreciate…

Justin Sullivan/Getty Images Nvidia’s stock has performed unbelievably well over almost any time period, creating enormous wealth for its shareholders. The company has grown from a relatively unknown designer of chips used in video games to the main beneficiary of the artificial intelligence boom. Nvidia joined the list of trillion-dollar…

Here’s what to watch at one of the most complicated Fed meetings in months Life’s what happens when you’re busy making other plans. That might as well be Fed Chair Jerome Powell’s slogan for the Fed’s March interest rate decision, expected today at 2 p.m. ET. At their most recent…

Editor's Pick