Lucy Lambriex/Getty Images Key takeaways Secured loans are popular for startups because they can be easier to qualify for and come with lower interest rates Unsecured loans are harder to obtain for new businesses and often require a personal guarantee Alternative financing options such as crowdfunding, peer-to-peer lending, business grants,…

Key takeaways Popular assumptions about credit and repayment are often wrong. Interest rate changes do not affect loan payments as much as you might think. Student loan consolidation and refinancing your student loans aren’t always financially beneficial. Most students need a cosigner to qualify for private student loans. Many misconceptions…

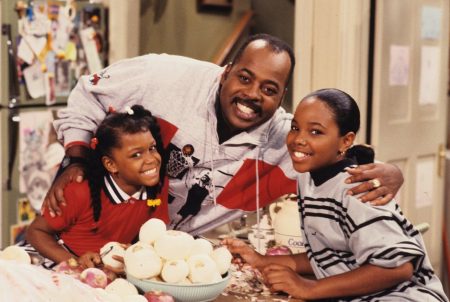

This is part 2 of 2 of Bankrate’s ’90s era lessons miniseries, focusing on loans. Key takeaways When it comes to applying for any type of loan, preparation is key. Improving your credit, lowering your DTI and decreasing the amount you need to borrow can help you qualify for a…

Mark Kantrowitz/Illustration by Bankrate Mark Kantrowitz is a nationally recognized expert on student financial aid and student loans. He often contributes comments on Bankrate’s student loan coverage (such as the recent court decision blocking the SAVE plan). Now, as a member of Bankrate’s Expert Contributor program, he will be penning…

Spotlight This Week

More ArticlesPersonal Finance

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

Lifestyle inflation occurs when your expenses increase as you earn more income. It can start subtly—dining at pricier restaurants, upgrading…

Chime, the largest digital bank in America, grew its revenue to $1.7 billion in 2024, an increase of roughly 30%…

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

Featured Articles

Key takeaways Foreclosure happens when a homeowner defaults on their mortgage payments and the lender takes control of the property. U.S. foreclosure rates are currently at record low levels, decreasing by 10 percent in 2024. Experts, who had expected foreclosures to return to pre-pandemic levels…

Dept Managmnt

Level 2: Discover the Fastest Way to Pay Off Debt With Rules and Challenges When looking for the fastest way to pay off…

Banking

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many banks from making…

Credit Cards

All News

Key takeaways Discharge policies on public student loans mean the loan terminates when you die. Many private student loans are also discharged upon death, though you will have to check the loan agreement. If you have a cosigner, they may be responsible for the loan if the lender only discharges…

Jackyenjoyphotography/Getty Images Warren Buffett increased Berkshire Hathaway’s stakes in five Japanese trading houses, according to regulatory filings Monday. The move comes weeks after Buffett told Berkshire shareholders that its stakes in the diversified companies were likely to “increase somewhat” over time. Japanese stocks closed higher, with the Nikkei 225 index…

Key takeaways Debt consolidation can be accomplished with a personal loan or credit card, depending on your needs and financial goals. Competitive rates typically go to those with good to excellent credit — FICO credit scores of 670 or above. Look for an interest rate that’s lower than what you…

Cryptocurrency is unavoidable in 2025. Reading headlines about crypto regulation, rapid asset price changes or even the latest memecoin may pique your interest in things like Bitcoin mining, investing risk and more. If you’re crypto curious, you’re not the only one. These are some of the most common questions people…

Key takeaways Feelings of shame or stress about debt can linger longer than one-time financial setbacks, causing more serious mental health effects in the long run. Not all debt is bad, and not all debt affects someone’s financial picture the same way. Don’t be afraid to reach out to a…

Key takeaways The safest way to send money isn’t always the most obvious one. Before choosing a method, weigh security, cost and accessibility based on your needs. Hidden fees and exchange rate markups can add up fast. Always compare both — not just one or the other. Speed vs. cost…

Understanding your car’s actual cash value (ACV) might be necessary when you are buying or selling a car, refinancing or need to know the car insurance market value for a claim. If needed, your insurance company will generally use its own proprietary calculations to determine ACV, but the formula is…

Key takeaways The National Credit Union Administration (NCUA) is the government agency that insures deposits at member credit unions. When your money is in a share account with a federally insured credit union, it’s protected by up to $250,000 per depositor, per federally insured credit union, per ownership category. For…

Key takeaways Money orders are safe, prepaid forms of payment that can be used in place of cash or checks. You can purchase money orders from post offices, grocery stores, banks and check-cashing stores for a small fee. Money orders are a safe alternative to checks or cash. These paper…

Credit Sesame’s personal finance news roundup March 15, 2025. Stories, news, politics, and events impacting personal finance during the past week. 2024 credit card debt and spending surgeConsumer debt growth slows in February 2025Government delays new tariffs on Mexico and CanadaConsumer confidence declines amid economic concernsJob openings hold steady, but…