Key takeaways Wire transfers cost more but provide familiar bank security. Crypto moves faster and costs less but requires some technical know-how. Bank fees often hit you twice — when sending and receiving. Crypto platforms charge one transaction fee, usually under $5. Bank wire transfers used to be the only…

Key takeaways Money stored in payment apps often lacks federal deposit insurance protection. Basic security practices significantly reduce the risks of fraud or theft. Apps earn interest on user balances while paying nothing to customers. Different apps serve different needs — personal, business or international use. Peer-to-peer payment apps have…

Key takeaways Most banks offer free coin exchange services to account holders, though you may need to roll coins yourself. Self-service coin-counting machines are more commonly found at local banks and credit unions than at national banks. Coinstar offers convenient coin exchange but charges steep fees unless you opt for…

Shares of Amazon closed the week looking unusually cheap. With its share price dipping and long-term growth potential still strong, investors might be looking at a solid buying opportunity. Amazon’s low valuation makes it attractive Amazon’s valuation is now at levels rarely seen since it went public in 1997. The…

Personal Finance

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

Lifestyle inflation occurs when your expenses increase as you earn more income. It can start subtly—dining at pricier restaurants, upgrading…

Chime, the largest digital bank in America, grew its revenue to $1.7 billion in 2024, an increase of roughly 30%…

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

Featured Articles

Key takeaways Generally, paying off your student loans with the highest interest rates first is the best repayment strategy. Consider paying off private student loans first due to higher rates, shorter repayment terms, lack of loan forgiveness, and lack of options for income-driven repayment. Student…

Dept Managmnt

Budgeting and Building an Emergency Fund for Rising Costs If rising costs are stressing you out, you may require adjustments to your budget…

Banking

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many banks from making…

Credit Cards

All News

Kansas offers a bit of everything: the urban energy of Kansas City, the college town vibe of Lawrence or the calm of the open prairie. If you’re a first-time homebuyer looking for financial help in the state, start with the Kansas Housing Resources Corporation (KHRC). The state’s primary housing agency…

Key takeaways Garages and other outbuildings can enhance your home’s fair market value, especially if they increase the usable or liveable space. Ways to finance a detached structure include a HELOC, home equity loan, cash-out refinance and renovation loan. There are pros and cons to each financing option, based on…

Images by Getty Images; Illustration by Issiah Davis/Bankrate The average savings account rate is a benchmark for the overall interest-rate environment, but it’s not a rate you should settle for. Rather, aim for an annual percentage yield (APY) many times the national average, such as those offered by high-yield savings…

Credit Sesame explains how to get debt under control, ease money-related anxiety, and take steps that could support your credit health over time. Living with debt can take a toll on more than your bank account. It can create ongoing stress, keep you up at night, and make it harder…

Key takeaways Refinancing your mortgage when your loan is almost paid off might make sense if your break-even period is less than two years away. Doing a cash-out refinance could also make sense, even if you’ve paid off a chunk of your loan balance. Making extra mortgage payments can help…

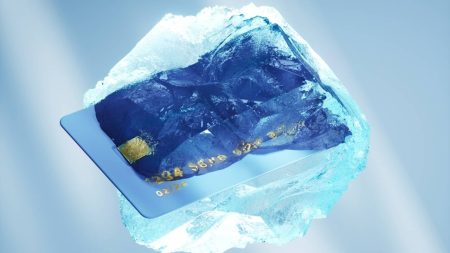

Photography by Getty Images Key takeaways Data breaches, financial fraud and internet crime have increased in recent years, so now’s the time to review how to protect your finances. If you haven’t already frozen your credit to prevent financial fraud, now may be the time to do it. Freezing your…

Key takeaways Credit default swaps are a financial derivative that large investors may use to insure their bond investments against default. CDS were right at the center of the 2007-2008 financial crisis, as many investors bought them to profit on the decline in debt securities. Credit default swaps (CDS) are…

Key takeaways Refinancing a rental typically has more stringent financial requirements than refinancing a primary residence. Refinancing a rental property can allow you to change the mortgage term, rate or both, or take out equity for financial needs. Refinancing isn’t just for a primary residence. If you have a mortgage…

Image by PM Images/Getty Images; Illustration by Hunter Newton/Bankrate Mortgage rates rose slightly this week, with the 30-year fixed rate averaging 6.78 percent, up from 6.76 percent the previous week, according to Bankrate’s latest lender survey. Current mortgage rates Loan type Current 4 weeks ago One year ago 52-week average…

The rise of “preventative Botox,” lip flips and even plastic surgery trends — all of which you’ll see when scrolling TikTok — might have you considering a cosmetic procedure or two. The International Society of Aesthetic Plastic Surgery reported that, from 2019 to 2023, the number of surgical and nonsurgical…

Editor's Pick