Real estate has a reputation for making people rich — and there’s truth to that. Historically, real estate has delivered solid returns, outpaced inflation and offered a reliable stream of passive income. Home appreciation rates, for example, tend to grow 4.5 percent annually on average, according to data from the…

Key takeaways Hardwood floors can potentially have a positive return on investment (ROI), unlike some other home improvement projects. Moving furniture, demolishing the current floor and preparing the subfloor should also be included in your budget. You can do some work yourself to save money, but working with a professional…

Key takeaways The lender, loan amount, interest and fees factor into the total cost of an LLC business loan Common loan fees include application, origination and prepayment fees Credit score, revenue, time in business, debts and profitability impact loan interest rates Getting an LLC loan is a great way to…

Key takeaways Asset protection trusts (APTs) are tools that offer protection from creditors while the creator of the trust is living. There are three types of APTS — domestic, foreign and Medicaid — all with their own advantages and disadvantages. APTs offer many benefits like wealth protection, tax efficiency and…

Personal Finance

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

Lifestyle inflation occurs when your expenses increase as you earn more income. It can start subtly—dining at pricier restaurants, upgrading…

Chime, the largest digital bank in America, grew its revenue to $1.7 billion in 2024, an increase of roughly 30%…

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

Featured Articles

We all use our checking accounts for the basic purposes — direct deposit of our paychecks, paying monthly bills and making debit card purchases. And while usually you’re seeing money leave your checking account, there are ways you can actually earn money with your checking…

Dept Managmnt

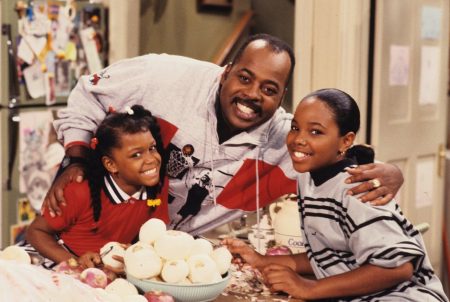

This is part 2 of 2 of Bankrate’s ’90s era lessons miniseries, focusing on loans. Key takeaways When it comes to applying for…

Banking

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many banks from making…

Credit Cards

All News

Key takeaways Giving a child a debit card can teach them financial responsibility and budgeting skills at a young age. Most banks offer checking accounts and debit cards for teens as young as 13 years old. The decision to give a child a debit card should be based on their…

Taking out an unsecured business loan gives business owners financing without securing the loan with collateral. These loans can be especially appealing to business owners who don’t have assets. Since these loans don’t require collateral, the eligibility requirements for some types are often more strict than other business loans, and…

Starting an emergency fund is often highlighted as a crucial aspect of personal finance, but we don’t talk as much about when you should tap into that money. For example, if someone faces an unexpected car repair bill, should they dip into their emergency fund or explore other financial avenues?…

With the excitement and emotions that come into play when adopting a pet, it’s easy to lose sight of what it takes to look after an animal for the rest of its life. And vet costs are one of the most important points to consider when evaluating your financial readiness…

The brother of Tesla CEO Elon Musk has been selling Tesla stock. Kimbal Musk has been offloading shares in recent months, just as Tesla stock has made a massive retreat from all-time highs that put the stock, however briefly, among the select group of trillion-dollar companies. Should this sale from an…

Monty Rakusen/Getty Images; Illustration by Austin Courregé/Bankrate Key takeaways A business equipment loan is designed specifically for buying equipment and is secured by the equipment itself Equipment loans can’t be used for any other business need Equipment leasing is another option, which could have lower upfront costs than a loan…

Key takeaways Small business loans work by giving you money to use for business purchases that you then repay over a set term with interest Approval for a small business loan typically requires a good credit score, solid business revenue and a personal guarantee or collateral There are many types…

Nearly one-third of American adults (30 percent) who looked for financial advice in 2023 turned to social media, according to Bankrate’s Financial Security Survey. Younger Americans are even more likely than the average to seek out financial advice from social media, potentially setting them off in the wrong direction during…

Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication. Key takeaways Bad credit business loans are…

Key takeaways Car salespeople receive commissions and bonuses for making sales, which can influence their tactics. Stick to your budget and not be swayed by add-ons or extras the salesperson offers. To give yourself more leverage, research the vehicles you’re interested in, know the value of your trade-in and secure…

Editor's Pick