Key takeaways Renegotiating your loan terms, refinancing or making extra payments can help lower your car payment. You can also sell your current car and buy one with a more budget-friendly payment but watch out for high interest rates. Before you buy, shop around and save for a large down…

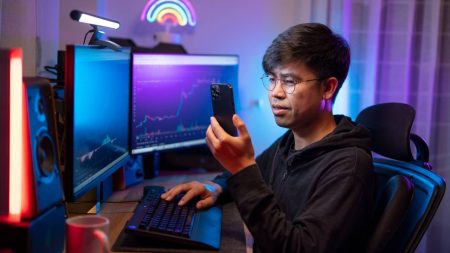

Investing in the stock market is one of the best ways to grow your money and build wealth over time. As businesses grow their earnings, shareholders are often rewarded with dividends and higher stock prices. Owning a diversified basket of stocks, such as an S&P 500 index fund, is one…

Key takeaways Managing an equipment loan requires you to estimate loan repayments, add the payments to your budget and monitor your revenue to ensure you can cover expenses. Setting up automatic payments and saving money during profitable seasons can help you stay on track with repayments If times are tough,…

Key takeaways Pet loans are a type of personal loan that can cover pet expenses, including routine care and surgeries. Pet loans are also available for purchasing a service, therapy or emotional support animal. It’s possible to qualify for a pet loan even with bad credit, but the interest rates…

Personal Finance

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

Lifestyle inflation occurs when your expenses increase as you earn more income. It can start subtly—dining at pricier restaurants, upgrading…

Chime, the largest digital bank in America, grew its revenue to $1.7 billion in 2024, an increase of roughly 30%…

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

Featured Articles

Key takeaways The interest rate on fixed-rate HELOCs stays the same, as opposed to fluctuating as it does with traditional HELOCs. Some lenders let you convert part of a traditional variable-rate HELOC balance to a fixed rate. Fixed-rate HELOCs may charge higher fees and come…

Dept Managmnt

Level 2: Discover the Fastest Way to Pay Off Debt With Rules and Challenges When looking for the fastest way to pay off…

Banking

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many banks from making…

Credit Cards

All News

The Nasdaq stock exchange contains some of the most attractive investments on the stock market, including quickly growing tech names. Investors can own them all by purchasing a Nasdaq index fund, making it easy to own such bellwethers as the Magnificent 7 stocks. But a variety of such funds exist,…

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that…

Stocks plummeted to start 2025, egged on by a slowing economy and U.S. President Donald Trump’s announcement of tariffs on major trading partners. Both the S&P 500 stock index and the tech-heavy Nasdaq index entered bear market territory, meaning they declined by 20 percent or more from a recent high.…

Key takeaways Improving business cash flow is vital to your business’s success, helping you ensure that you always have enough cash to cover your bills, payroll and debts Planning ahead for cash needs and cutting unnecessary spending can support better cash flow management Get paid quickly by offering discounts and…

There are several ways for investors to add stable investments that provide a stream of income to their portfolios. One of the most common ways to do so is by investing in dividend stocks. In fact, there are some companies, referred to as Dividend Aristocrats, that have consistently been raising…

Investing in 2025 is more accessible than ever — but it isn’t always easy. With nearly constant market volatility and financial advice flooding your social media feed, it’s easy to make mistakes that hurt your long-term returns. Whether you have $5 or $500,000, avoiding these common traps can save you…

President Donald Trump has announced, rescinded, raised and adjusted dozens of tariffs over the first months of his presidency, leaving business owners scratching their heads as to when and how they should brace for impact. As the tariff situation develops, many small business owners are worried about how import taxes…

Mongkol Chuewong/Getty Images Global Entry is a U.S. Customs and Border Protection (CBP) program that allows pre-approved, low-risk travelers to expedite the customs and immigration process upon arrival in the United States. This benefit can save a lot of time after a long trip home. Signing up for Global Entry…

Key takeaways The Capital One Venture X Rewards Credit Card charges a lower annual fee than competing cards from other issuers, yet still comes with its share of premium travel benefits. Not only does this card offer broad airport lounge access, but it includes a $300 annual travel credit, a…

Bitcoin and other cryptocurrencies have been extremely volatile over the past 15 years since being introduced. These digital assets are often touted for their protection against inflation and potential for long-term stability, but the reality is they’ve behaved more like risky assets during periods of market upheaval. As of April…