In several media reports, Monday’s (June 10) DJT decline was linked to Trump Media’s SEC Form S-1/A (“A” for amended) filing. (For example, the Barron’s article, ” Trump Media Stock Slumps on Filing of Reaudited Finances.”) However, that decline was not due to the “reaudit.”

First, look at the decline’s characteristics

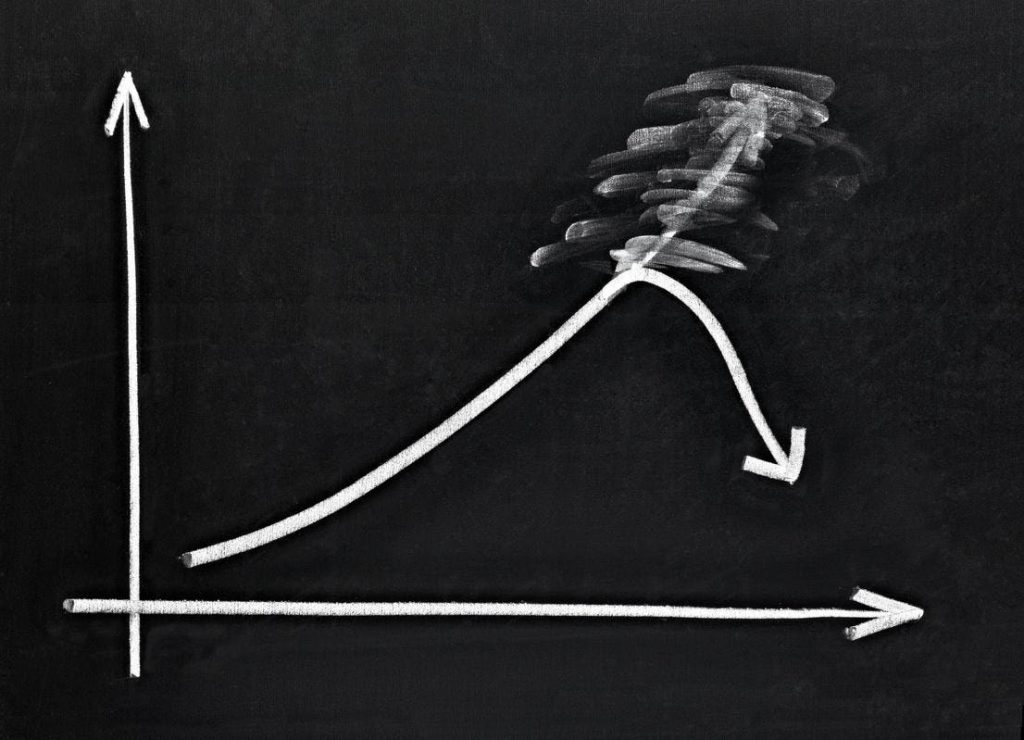

Once again, the stock is having trouble with price barriers. These are especially important now because the stock’s fundamental valuation is well below the current price. Is this the beginning of a new selloff? Could be, because there are uncertainties at work.

Why the reaudit did not cause the stock decline

Note: As a reminder, Trump Media’s former auditor was BF Borgers CPA PC. The SEC recently cited Borgers for fraud and disallowed it to perform audits. Therefore, Trump Media hired a new auditor (Semple, Marchal & Cooper, LLP) to reaudit its finances.

The conclusion in the Semple audit report to the Board was good:

“In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2023 and 2022, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.”

That report is in the S-1/A filing on pages F-1 to F-6. (FYI – All Trump Media SEC filings are accessible in the Trump Media website.)

The new auditor’s changes were mostly miniscule (a couple of $hundred here and there). There also was a recategorization of the operating lease’s flows and values. And there were some immaterial formatting changes. The net effect was that there were no material changes to the balance sheet, income statement, or cash flow statement.

The real reason for the decline: Potential sellers are on the horizon

The SEC Form S-1/A filing restarted the SEC approval process. The SEC says it typically approves S-1 filings within 30 days. When that happens, all 176 million shares will be registered, and the shareholders will be able to sell, EXCEPT…

Many of the shareholders are bound by a “lock-up” restriction that postpones their ability to sell until six months after the March 25 merger (that is, September 25). The portion of outstanding shares under the lock-up provision is 73.9%.

Note: There are two reasons the lock-up could end earlier. From page 4 of the S-1/A filing:

“ ‘Lock-up Period’ means the period beginning on March 25, 2024 and ending on the earliest of (i) September 25, 2024, (ii) the date on which the closing price for the Common Stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalization and the like) for any 20 trading days within any 30-trading day period commencing on August 22, 2024, and (iii) the date on which the Company consummates a liquidation, merger, share exchange or other similar transaction that results in all of the Company’s stockholders having the right to exchange their equity holdings in the Company for cash, securities or other property.”

As to the 30 days, it could be shorter because the SEC has already reviewed most of the same material that was in the original S-1 filing.

So… Some of the newly registered shares will be salable soon, with the bulk becoming salable by September 25.

But will shareholders sell or hold?

Certainly, some will sell. The shareholders who received stock for services rendered or for repayment of loans could be the first to cash in, having concluded their dealings with Trump Media. Also, those initially associated with Digital Acquisition could view the point of salability as the goal of their first-in efforts. Finally, there are the shareholders who would like to cash in some or all of their holdings.

Therefore, expect selling. The question then is, who will buy? With the fundamental value being low, the Trump name will more likely be the attraction. And that does not mean just those who attend Donald Trump’s rallies. Others who wish to support his activities prior to the election could be willing buyers as well.

Do not dismiss short sellers

The current short interest (about 4.5M shares) is running about 10% of the “float” shares. Those are the 44M tradeable shares out of the 176M outstanding shares. (176M times $39 equals Trump Media’s $6.9B market capitalization). Once all the 176M shares are registered and the lock-up period has ended, the float will have quadrupled.

Remember that short sellers are not bad actors. They are part of the market-making process, with a sell high, buy low style of investing. They help keep stock prices and valuations in line.

The bottom line: Uncertainties are affecting DJT

The registration of shares that then become tradable could produce selling, even as the stock price falls. Clearly that is an unwanted uncertainty for shareholders.

Then there are the short sellers who can exacerbate any selloff, so long as the valuation remains well below the stock price.

Finally, there are Trump Media’s fundamentals. Yes, the company got cash from the merger, but what about the business? With no earnings call information for the first quarter’s results, the second quarter becomes very important. That means both the results of that quarter, which is nearing its end now, and management’s explanations of what it is doing to produce future growth and profitability.

With uncertainties, time will tell.

Read the full article here