Key takeaways

- Secured loans require collateral, like a car or home, while unsecured loans do not.

-

Lenders may offer lower interest rates and larger borrowing limits on secured loans.

-

Common examples of secured loans are auto loans, mortgages and business financing.

-

A lender can repossess the collateral if you can’t repay a secured loan, so it poses less of a risk to the lender but more risk to you as a borrower.

When you take out a secured loan, you allow a lender to place a lien against something you own — or are financing — in exchange for borrowing money. Your asset gives the lender extra “security” that you’ll repay the loan. If you default on a secured loan, the lender can take your asset and sell it to recoup the unpaid loan balance.

Secured loans are typically easier to qualify for and have lower interest rates because they pose less risk to the lender. Knowing precisely what you are promising and what you stand to lose is important before you take out a secured loan.

What is a secured loan?

Secured loans are debt products backed by an asset that you own. When you apply for a secured loan, the lender will need to know which of your assets you plan to use as collateral.

You can pledge your car, home or other asset as collateral for a secured loan, and the lender will place a lien on that asset until the loan is repaid. If you default, the lender can claim and sell the collateral to recover the loss.

Most secured loans are installment loans, meaning you receive all your funds at once and make equal monthly payments until the loan is paid in full. Interest rates are typically fixed, and repayment terms may be as short as one year for a secured personal loan or as long as 30 years for a mortgage.

How does a secured loan work?

The process of applying for a secured loan will vary depending on what type of secured loan you need. Home loans are the most involved, requiring a deeper dive into your employment, assets, credit history and the value of the home you’re buying or refinancing.

Car, boat and RV loans require less paperwork, and can often be approved relatively quickly. Secured personal loans work similarly to vehicle loans and require that you prove the value and ownership history of the asset you’re using as collateral for the loan.

The application process involves checking your credit score, getting an estimate of your collateral’s value and shopping around with at least three lenders to find the best deal. Most offer preapproval, which will allow you to check your potential rates without affecting your credit score. When you’re ready to formally apply, gather the requested financial documents, submit the application and, if approved, close your secured loan.

Types of secured loans

You may be able to get a secured loan using any asset with sufficient, verifiable value that you can prove you own, assuming you meet the lender’s eligibility requirements. Most secured loans fall into these categories:

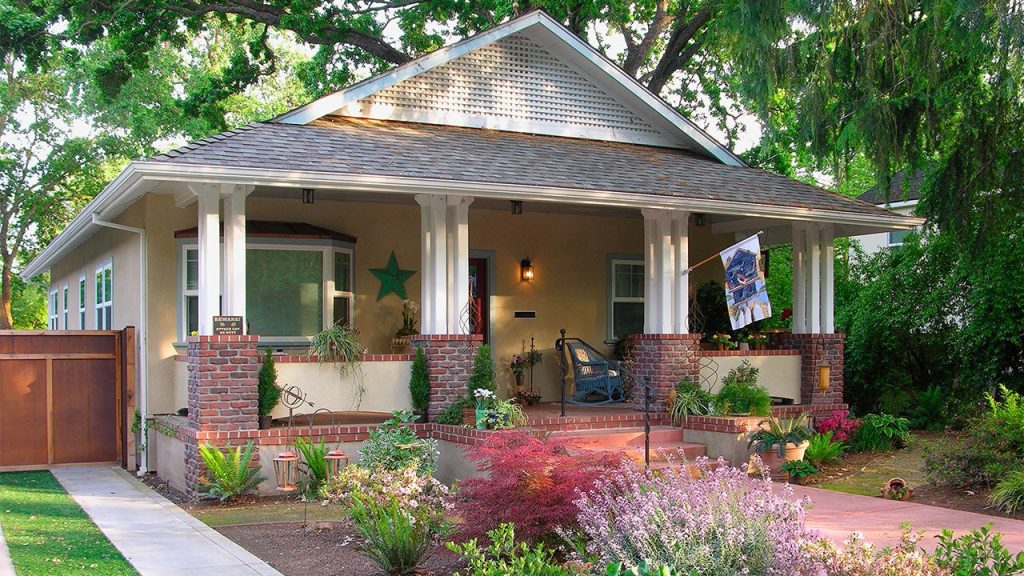

- Mortgages: With a mortgage, you put your home or property up as collateral for financing. You can typically borrow hundreds of thousands of dollars and spread the payments out with terms of up to 30 years. If you fail to make the payments, the lender can foreclose on your home.

- Home equity line of credit: A home equity line of credit (HELOC) allows you to borrow a portion of your home’s equity with a revolving credit line that works like a credit card. Like a mortgage, a HELOC requires you to put your home up as collateral.

- Home equity loan: Like a HELOC, a home equity loan uses your home’s equity as collateral. It has the same risks, but the major difference is how you receive your funds. Home equity loans are funded as a lump sum.

- Auto loans: When taking out a loan to pay for a car or any other vehicle, your vehicle is used as collateral. If you don’t make the payments on time and in full, it could be repossessed.

- 401(k) loan: If you have money vested in a retirement account through your employer, you may be eligible to borrow against some of its value with a 401(k) loan. Rates are typically low, interest is paid back to your retirement account and the payments are deducted from your regular paycheck until they’re paid off.

- Loan for land: A land loan is used to finance the purchase of land. This type of loan uses the land itself as collateral.

- Business loan: A secured business loan can be used to buy equipment, pay wages or invest in business projects. There are many assets you can use as collateral, including inventory, equipment or your land or building.

Common types of collateral

What you use as collateral likely will depend on whether your loan is for personal or business use. Some examples of collateral include:

- Real estate, including equity in your home

- Cash accounts

- Cars, boats, RVs or other vehicles

- Machinery and equipment

- Investments

- Insurance policies

- Valuables and collectibles

Pros and cons of secured loans

Secured loans offer many advantages, like potentially lower interest rates, but they also have some risks.

Pros

- Easier qualifying standards: You can get a secured loan with lower credit scores or less income.

- Larger borrowing limits: You may qualify for a larger loan amount with a secured loan versus an unsecured loan.

- Lower average rates: Lenders typically offer lower rates for secured loans than unsecured ones.

Cons

- Risk of losing your asset: Lenders can collect on an unpaid secured loan by seizing the asset you offered as collateral.

- Your asset must qualify: Secured lenders will assess the value of your home, car or other asset to determine whether it’s worth enough to support the loan you apply for.

- More involved application: The secured loan process may require more documentation and take longer to fund than unsecured loans.

Secured loans vs. unsecured loans

If you’re trying to decide between a secured or unsecured loan, it’s helpful to understand how each works. Choosing one or the other often comes down to how much you need to borrow, what you need the money for, how quickly you need it and whether you meet the qualifying requirements.

Secured loan benefits

- Lower rates and fees: You’ll typically find lower rates on secured loans because they are less risky than unsecured loans. For borrowers with bad credit, unsecured bad credit loan rates can be as high as 36 percent.

- Larger loan amounts: Because secured loans are tied to the value of the asset you put up as collateral, lenders often allow you to borrow larger loan amounts. Unsecured lenders typically limit loan amounts to $50,000 or less.

- Longer repayment terms: With a secured mortgage loan, you can spread your payment out for as long as 30 years. Terms are usually limited to one to seven years with an unsecured loan.

Unsecured loan benefits

- Funds available faster: Unsecured loans can be funded quickly, often in as little as one business day after approval, making it a good choice if you need funds quickly. Some secured loans, like mortgages, can take up to six weeks to fund.

- No collateral required: If you prefer not to risk losing your car, home or other asset due to default, an unsecured loan is a better option. However, there are still consequences for defaulting on an unsecured loan.

- More flexibility: Unsecured personal loan funds can be used for just about any legal purpose, from debt consolidation to emergency expenses. There’s no collateral to approve, so the funds are yours to use as needed.

Secured loans and default

If you default on a secured loan, the lender can begin the process of repossessing the asset attached to the loan. It can take several months, and the lender may offer various options to help you if you have financial problems.

If you lose an asset due to repossession or foreclosure, you may still owe money on the debt if the repossessed asset doesn’t sell for enough to cover the amount of your loan. Depending on your state, a lender can sue you in court for a deficiency judgment, creating a public record that stays on your credit report for seven years.

Houses, land and business assets typically take longer to sell, which may give you more time to find a way to get caught up on your payments. Some states require a lender to go to court to foreclose on a property, which can take upward of a year. In other states, the lender must provide you with advance notice of foreclosure, but it can take as little as two months and is settled out of court.

What to do if you can’t repay a secured loan

If you’re having difficulty repaying a secured loan, there are a few steps you can take.

- Contact the lender: Contact your lender to discuss your options. The lender may agree to modify your loan terms, including a new payment schedule, new repayment term or temporarily pause payments via loan deferment.

- Seek financial help: You can reach out to a consumer credit counseling agency certified by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Also consider speaking with a U.S. Department of Housing and Urban Development-approved housing counselor to help you negotiate loan modification terms with your mortgage provider.

- Prioritize your bills: Always focus on paying secured debts that could affect your basic needs. For example, if you must choose between making credit card and car payments, choose the car payment. A car is needed for transportation to and from work or to take children to and from school, whereas credit cards don’t typically meet any critical day-to-day needs.

Bottom line

A secured loan can be a cost-effective financing option if you buy a high-value asset, like a car or home. Carefully research and compare options before applying for a secured loan so you understand the benefits and potential consequences. When deciding between a secured and unsecured loan, consider your needs, the amount you need to borrow and your ability to meet qualifying requirements.

Read the full article here